If the idea of budgeting makes you want to hide under a blanket because numbers feel like a foreign language, you’re not alone. Math might not be your thing, and that’s okay—budgeting isn’t about solving equations or being a human calculator. It’s about taking control of your money so you can live life on your terms.

The good news? You don’t need a finance degree or a love for spreadsheets to make budgeting work for you.

#7 Simple Budgeting Tips for Women

- Tips 1: Find Your “Why” – The Secret to Sticking With It

- Tips 2: Ditch the Spreadsheets – Use Visual Tools Instead

- Tips 3: The 50/30/20 Rule – Budgeting Made Brain-Dead Simple

- Tips 4: Cash Envelopes – Your Grandma’s Genius Hack

- Tips 5: Automate – Set It and Forget It

- Tips 6: Round Numbers – Because “Close Enough” is Good Enough

- Tips 7: Round Numbers – Because “Close Enough” is Good Enough

Here are seven simple, math-free tips to help you manage your money with confidence—no calculator required.

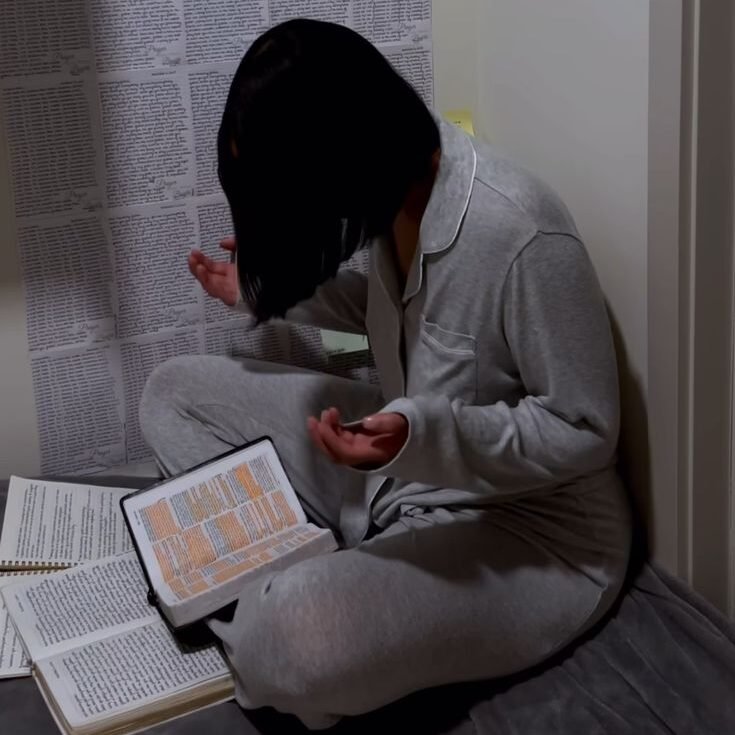

Tips 1: Find Your “Why” – The Secret to Sticking With It

Let’s be real: Budgeting sounds about as fun as folding laundry. But just like folding laundry gives you that satisfying pile of fresh clothes, budgeting gives you something way bigger—like peace of mind, a vacation fund, or freedom from debt.

Start by asking yourself: Why do I want to budget?

- Is it to save for a dream trip?

- To stop stressing about bills?

- To finally ditch credit card debt?

Write your “why” on a sticky note and put it where you’ll see it daily (your fridge, phone lock screen, or bathroom mirror). When budgeting feels tedious, that reminder will keep you motivated.

Tips 2: Ditch the Spreadsheets – Use Visual Tools Instead

If rows of numbers make your eyes glaze over, skip the spreadsheets. Instead, use visual tools that feel intuitive:

- Budgeting Apps: Apps like Mint or PocketGuard automatically track your spending and categorize it for you. All you do is check the colorful charts!

- Pen and Paper: Grab a notebook and draw simple pie charts or bar graphs to see where your money goes.

- Jars or Envelopes: Literally divide cash into jars labeled “Groceries,” “Fun Money,” or “Bills.” When the jar is empty, you’re done spending in that category.

Visuals help you “see” your money without crunching numbers.

Tips 3: The 50/30/20 Rule – Budgeting Made Brain-Dead Simple

One of the most common travel mistakes is overpacking. It’s easy to fall into the trap of thinking you need to bring your entire wardrobe and every gadget you own on your international trip. However, limiting unnecessary items is a key principle of efficient packing. When you limit unnecessary items, your luggage becomes significantly lighter. This has several advantages. It makes it easier to maneuver your suitcase through airports, train stations, and crowded city streets.

- Reducing baggage weight

- Efficient packing and unpacking.

- Enhanced security and peace of mind.

It simplifies your travel experience, reduces stress, and allows you to focus on the true essence of your journey – exploring new cultures, savoring delicious food, and creating lasting memories. So, remember, less is often more when it comes to packing for your adventure abroad.

Tips 4: Cash Envelopes – Your Grandma’s Genius Hack

This old-school trick works like magic:

- Label envelopes for spending categories (e.g., “Groceries,” “Eating Out”).

- Put cash in each envelope at the start of the month.

- When the cash runs out, stop spending in that category.

Why it works: Physically seeing money disappear helps you spend mindfully. No apps, no math—just cold, hard cash.

Tips 5: Automate – Set It and Forget It

Let technology do the heavy lifting:

- Auto-Pay Bills: Never miss a due date (or pay a late fee).

- Auto-Save: Set up automatic transfers to savings accounts. Even $20 a week adds up!

- Round-Up Apps: Apps like Acorns round up your purchases to the nearest dollar and invest the spare change.

Automation means you’re budgeting without lifting a finger.

Tips 6: Round Numbers – Because “Close Enough” is Good Enough

Forget pennies and exact amounts. Round everything to the nearest 10 or 25.

- Earn 2,463? Call it 2,500 for simplicity.

- Spent 47 on gas?Round it to 50 instead.

This makes tracking easier and reduces stress over tiny details.

Tips 7: Celebrate the Tiny Victories – You’re Doing Amazing!

Budgeting isn’t about perfection—it’s about progress. Celebrate small wins to stay motivated:

- Saved $5 this week? Treat yourself to a fancy coffee.

- Stuck to your grocery budget? Do a happy dance!

Every step forward counts, even if it’s tiny.

You’ve Got This!

Budgeting isn’t about being a math genius. It’s about making your money work for you. Start with one tip that feels doable, and build from there. Remember, even baby steps add up over time.

So grab that first envelope, download that app, or scribble your “why” on a napkin—you’re already winning just by trying. And hey, if all else fails? There’s always room for another happy dance. 💃

P.S. Your future self will high-five you for this.